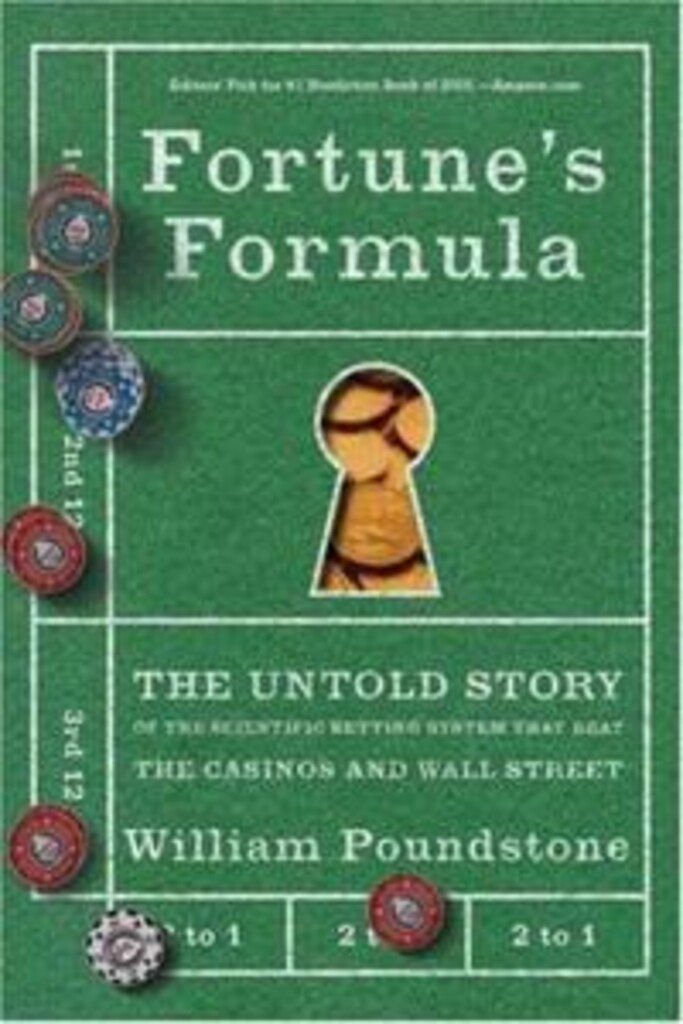

Fortune's formula : the untold story of the scientific betting system that beat the casinos and Wall Street

William Poundstone

Bok · Engelsk · 2006

| Utgitt | New York : Hill and Wang , 2006

|

|---|---|

| Omfang | X, 386 sider : ill.

|

| Opplysninger | In 1956 two Bell Labs scientists discovered the scientific formula for getting rich. One was mathematician Claude Shannon, neurotic father of our digital age, whose genius is ranked with Einstein's. The other was John L. Kelly, Jr., a Texas-born, gun-toting physicist. Together they applied the science of information theory--the basis of computers and the Internet--to the problem of making as much money as possible, as fast as possible. Shannon and MIT mathematician Edward O. Thorp took the Kelly formula to the roulette and blackjack tables of Las Vegas. It worked. They realized that there was even more money to be made in the stock market, specifically in the risky trading known as arbitrage. Thorp used the Kelly system with his phenomenonally successful hedge fund Princeton-Newport Partners. Shannon became a successful investor, too, topping even Warren Buffett's rate of return and using his wealth to drop out of the scientific world. Fortune's Formula traces how the Kelly formula sparked controversy even as it made fortunes at racetracks, casinos, and trading desks. It reveals the dark side of this alluring scheme, which is founded on exploiting an insider's edge. The cast of character spans J. Edgar Hoover, Rudolph Giuliani, Michael Milken and Warren Buffett; Hollywood producers, Wall Street crooks, snarky Nobel Laureates, and the Jewish mob.

|

| Emner | |

| Dewey | |

| ISBN | 978-08-09-04599-0 : Nkr 150,00

|

| Hylleplass | 795.0151 POU

|